In today’s digital age, it’s essential for individuals to stay informed about various forms and documents required for financial purposes. One such significant document is the IRS Form W-4, also known as the Employee’s Withholding Certificate. Whether you’re an employee or an employer, understanding how to fill out this form correctly is crucial. To help you navigate through this process, we have compiled a list of resources that provide printable versions of the W-4 form and comprehensive guides on how to complete it.

IRS Form W-4 Printable - 2022 W4 Form

Starting with the first resource, this website provides a printable version of the 2022 W4 Form. It allows you to download a fillable PDF or fill it out online. This convenient option gives you flexibility in choosing the method that suits your preferences and needs. The form is easily accessible and can be completed at your convenience.

Starting with the first resource, this website provides a printable version of the 2022 W4 Form. It allows you to download a fillable PDF or fill it out online. This convenient option gives you flexibility in choosing the method that suits your preferences and needs. The form is easily accessible and can be completed at your convenience.

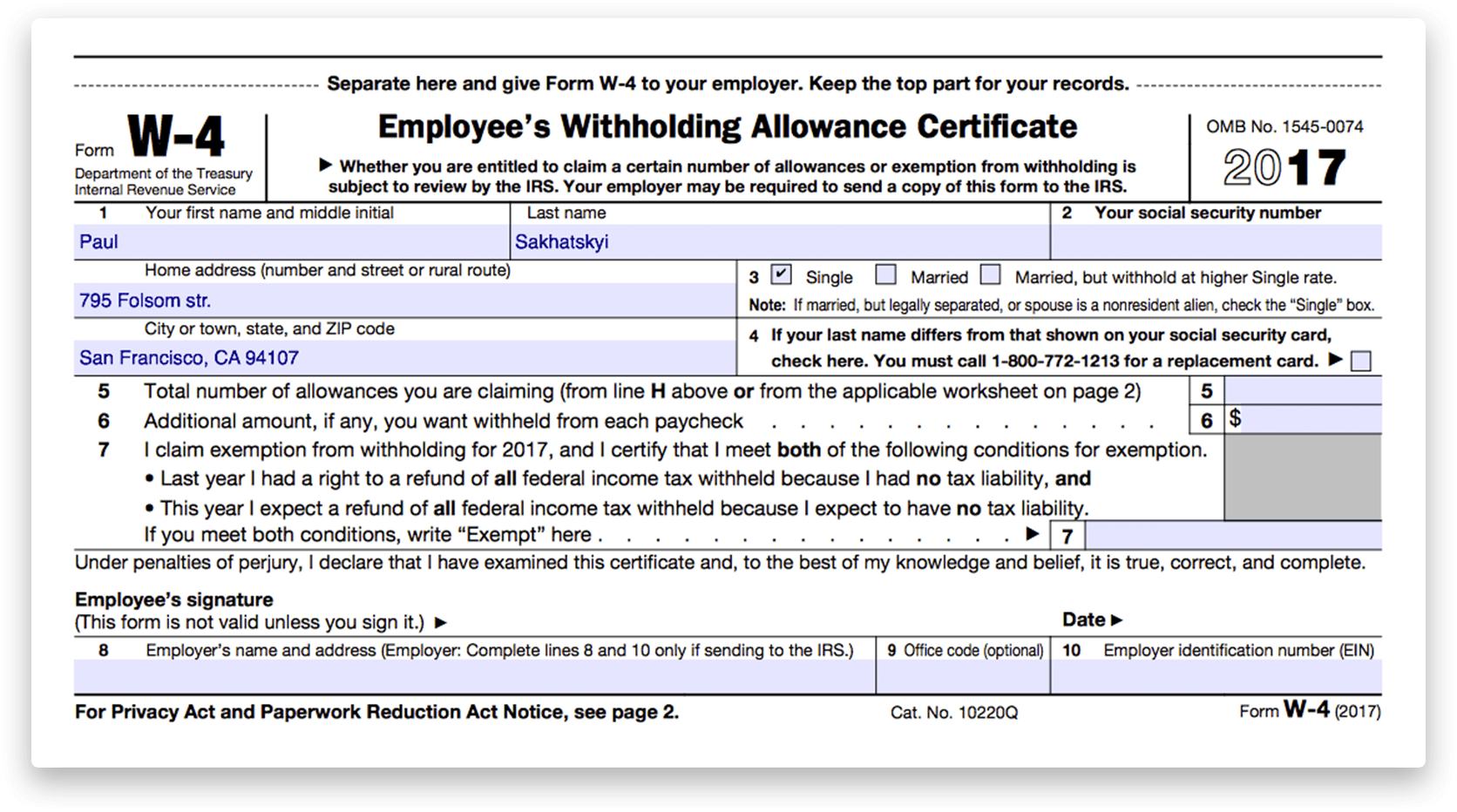

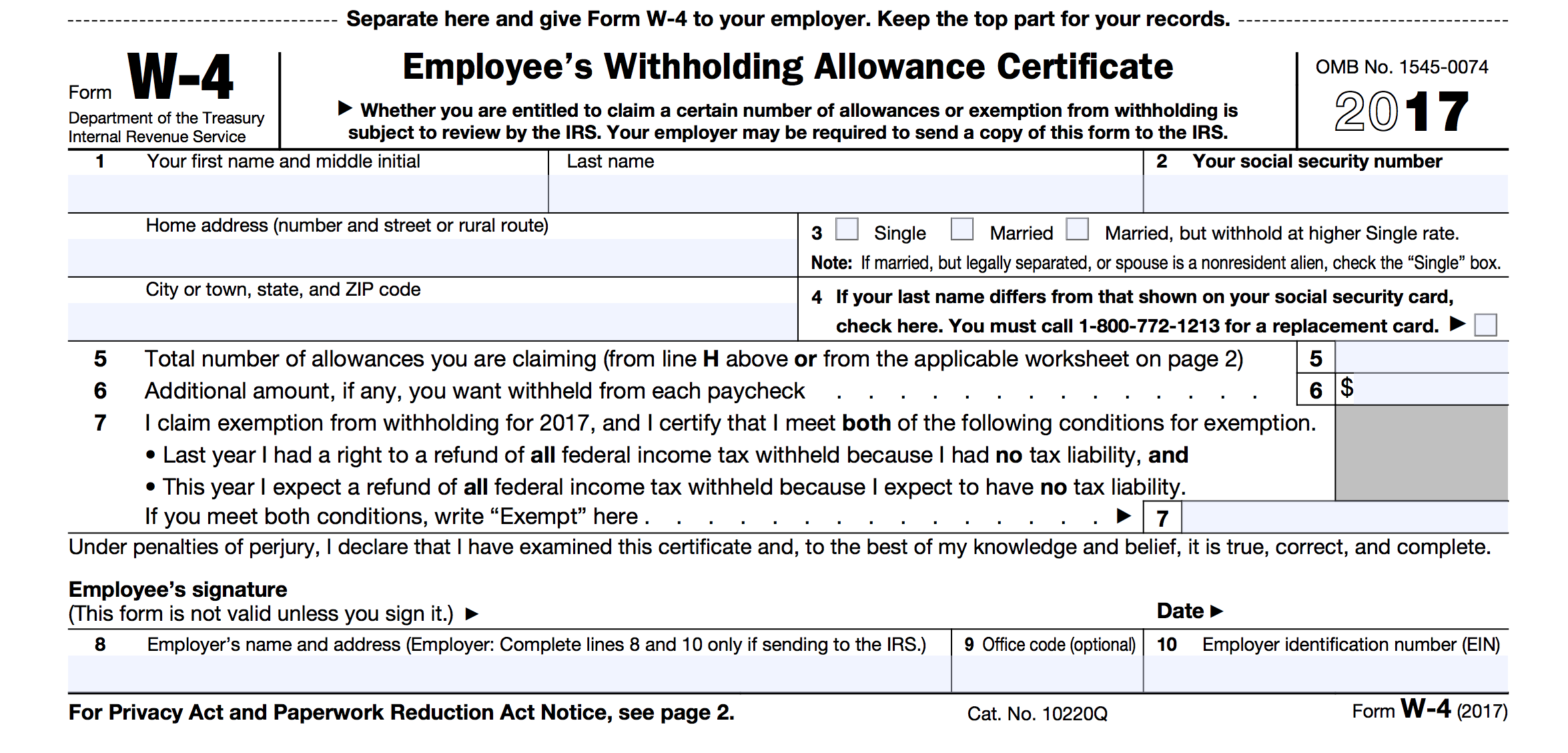

How to fill out 2018 IRS Form W-4 | PDF Expert

PDF Expert provides a comprehensive guide on how to fill out the 2018 IRS Form W-4. This resource breaks down each section of the form and provides detailed explanations to ensure accuracy. Following this guide will ensure that you correctly calculate your withholding allowances and keep your tax obligations in order.

PDF Expert provides a comprehensive guide on how to fill out the 2018 IRS Form W-4. This resource breaks down each section of the form and provides detailed explanations to ensure accuracy. Following this guide will ensure that you correctly calculate your withholding allowances and keep your tax obligations in order.

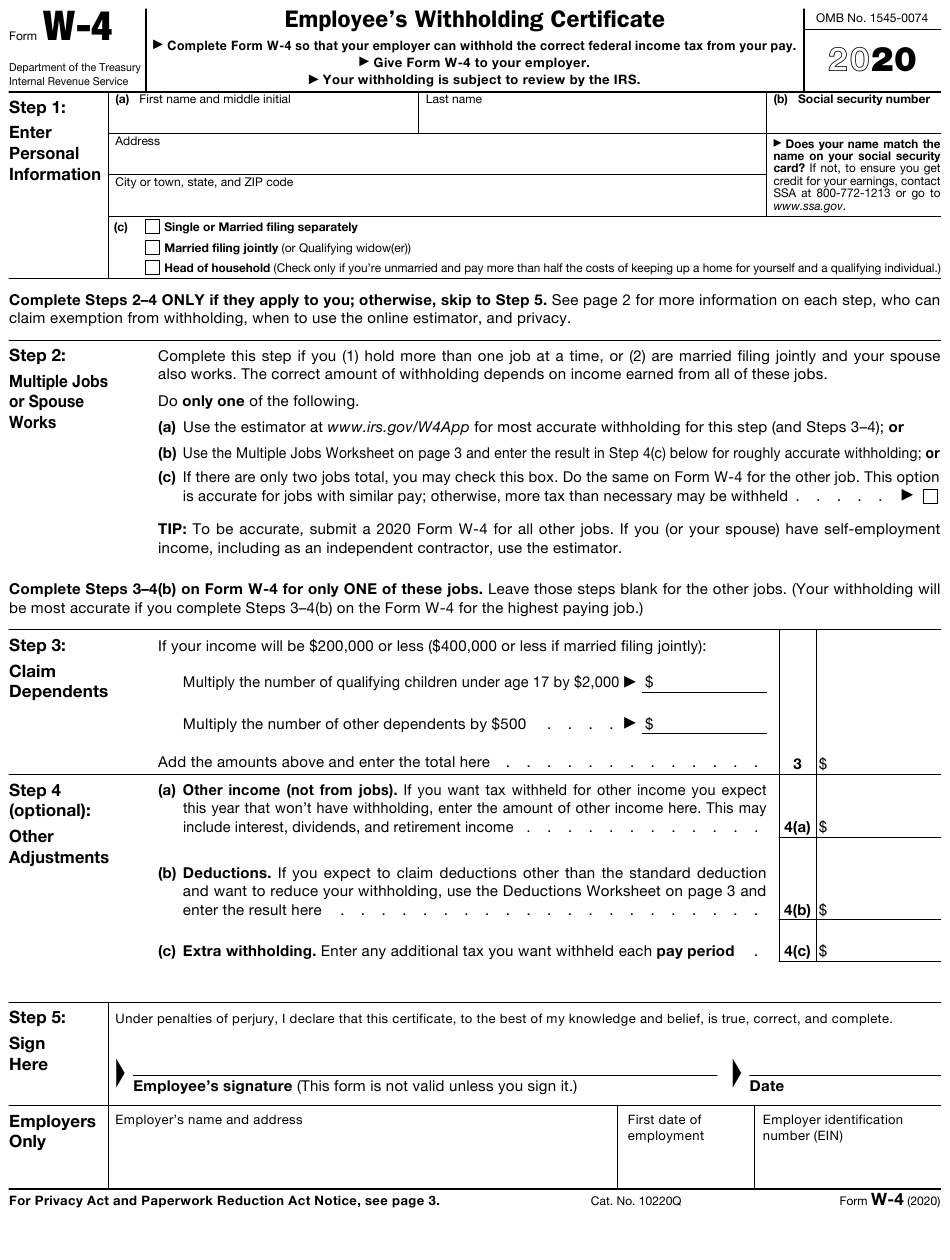

Federal W 4 Worksheet 2020 - Printable & Fillable Online Blank | Download PDF Template for FREE

If you’re looking for a printable and fillable version of the Federal W 4 Worksheet for the year 2020, this resource is the perfect fit. The online blank template allows you to download it for free and fill it out according to your personal information. It simplifies the process and ensures you adhere to the necessary guidelines.

If you’re looking for a printable and fillable version of the Federal W 4 Worksheet for the year 2020, this resource is the perfect fit. The online blank template allows you to download it for free and fill it out according to your personal information. It simplifies the process and ensures you adhere to the necessary guidelines.

Printable W 4 Forms - 2022 W4 Form

For those seeking a printable version of the 2022 W4 Form, this resource provides easy access. The form is available for download, enabling you to complete it at your convenience. This option ensures you have a physical copy on hand and can refer to it as needed.

For those seeking a printable version of the 2022 W4 Form, this resource provides easy access. The form is available for download, enabling you to complete it at your convenience. This option ensures you have a physical copy on hand and can refer to it as needed.

Wisconsin W 4 Form Printable - 2022 W4 Form

If you’re looking specifically for a printable version of the Wisconsin W 4 Form for the year 2022, this resource is tailored to your needs. It provides a downloadable form that you can print and fill out at your convenience. It simplifies the process and ensures accuracy.

If you’re looking specifically for a printable version of the Wisconsin W 4 Form for the year 2022, this resource is tailored to your needs. It provides a downloadable form that you can print and fill out at your convenience. It simplifies the process and ensures accuracy.

W4 Form Example For Single 2023 - W-4 Forms - Zrivo

If you’re unsure about how to fill out the W-4 form as a single individual for the year 2023, this resource provides a helpful example. By referring to the example provided, you can gain clarity on how to accurately complete the form and meet your tax obligations.

If you’re unsure about how to fill out the W-4 form as a single individual for the year 2023, this resource provides a helpful example. By referring to the example provided, you can gain clarity on how to accurately complete the form and meet your tax obligations.

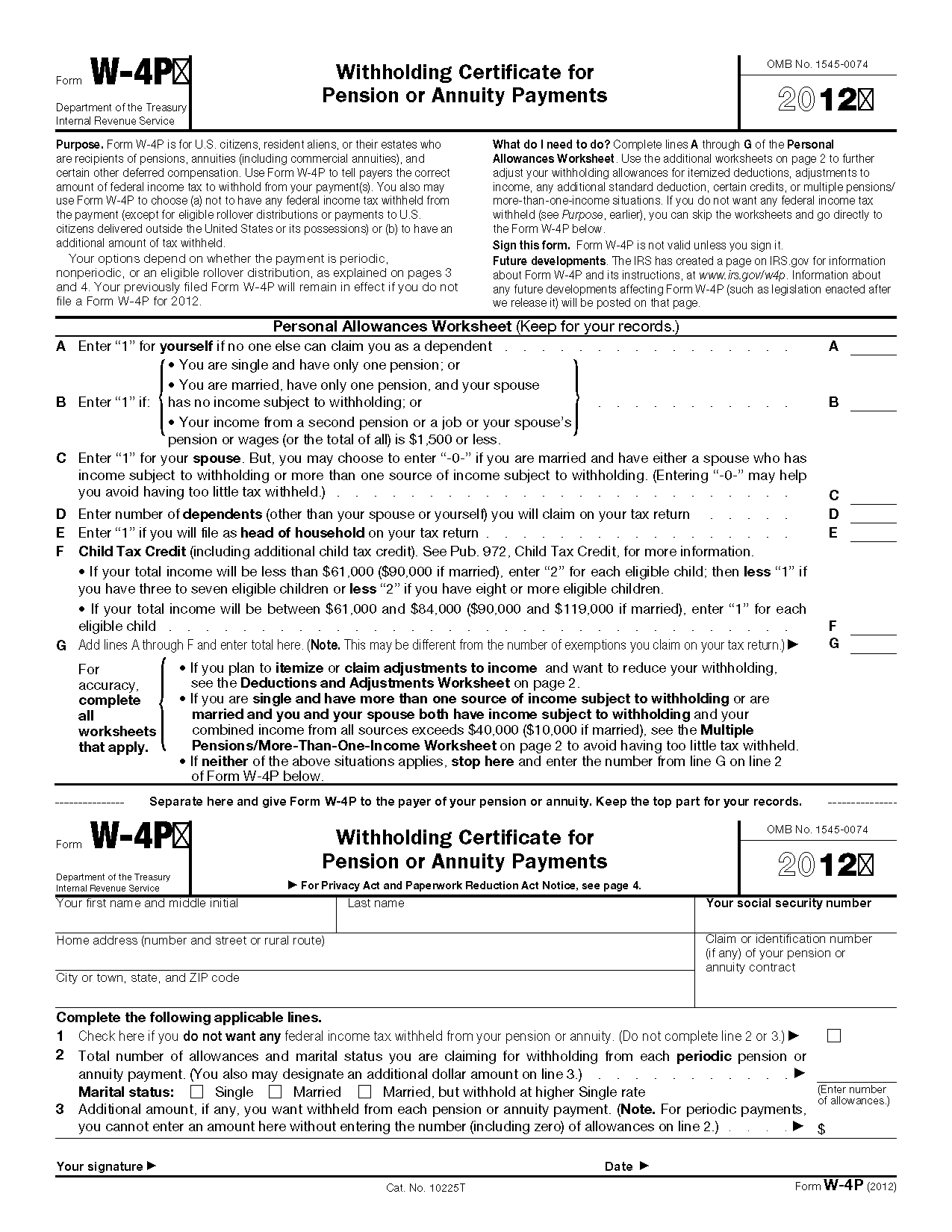

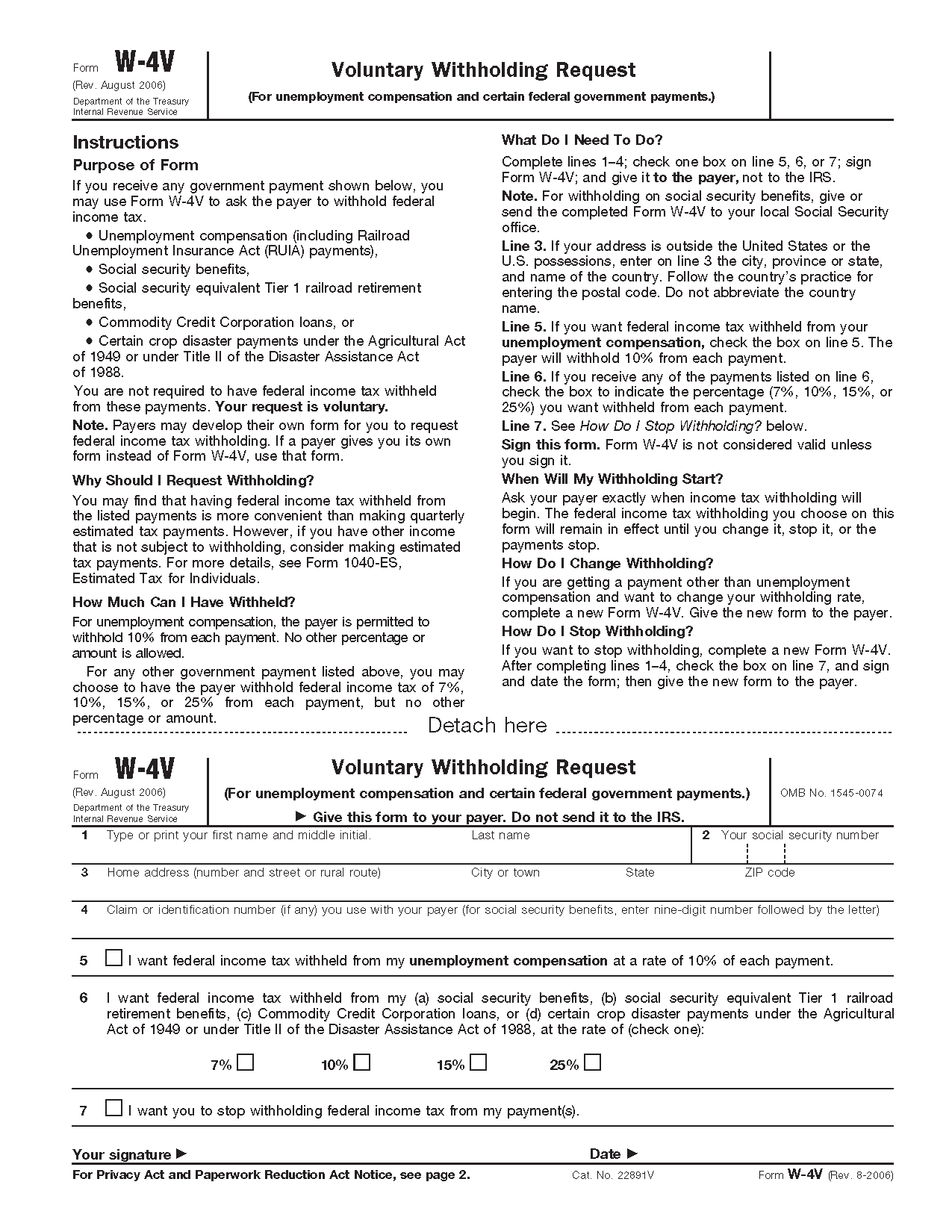

Printable W-4V IRS Form - 2022 W4 Form

If you need to know how to fill out a W-4V IRS Form for the year 2022, this resource is perfect for you. It provides a printable version of the form that you can easily download and complete. This ensures you can follow the necessary steps accurately and fulfill your responsibilities.

If you need to know how to fill out a W-4V IRS Form for the year 2022, this resource is perfect for you. It provides a printable version of the form that you can easily download and complete. This ensures you can follow the necessary steps accurately and fulfill your responsibilities.

Free Printable W-4 Forms - 2022 W4 Form

Another excellent resource for accessing a free printable version of the W-4 form is this website. It provides a downloadable sample form for the year 2022. By using this resource, you can easily print out the form and complete it accurately.

Another excellent resource for accessing a free printable version of the W-4 form is this website. It provides a downloadable sample form for the year 2022. By using this resource, you can easily print out the form and complete it accurately.

Blank w4 form Fill Online, Printable, Fillable, Blank - PDFfiller

PDFfiller offers a versatile solution for filling out the W4 form online. By accessing this resource, you can complete the blank form digitally, ensuring accuracy and efficiency. This online platform eliminates the need for printing and allows you to handle the process entirely online.

PDFfiller offers a versatile solution for filling out the W4 form online. By accessing this resource, you can complete the blank form digitally, ensuring accuracy and efficiency. This online platform eliminates the need for printing and allows you to handle the process entirely online.

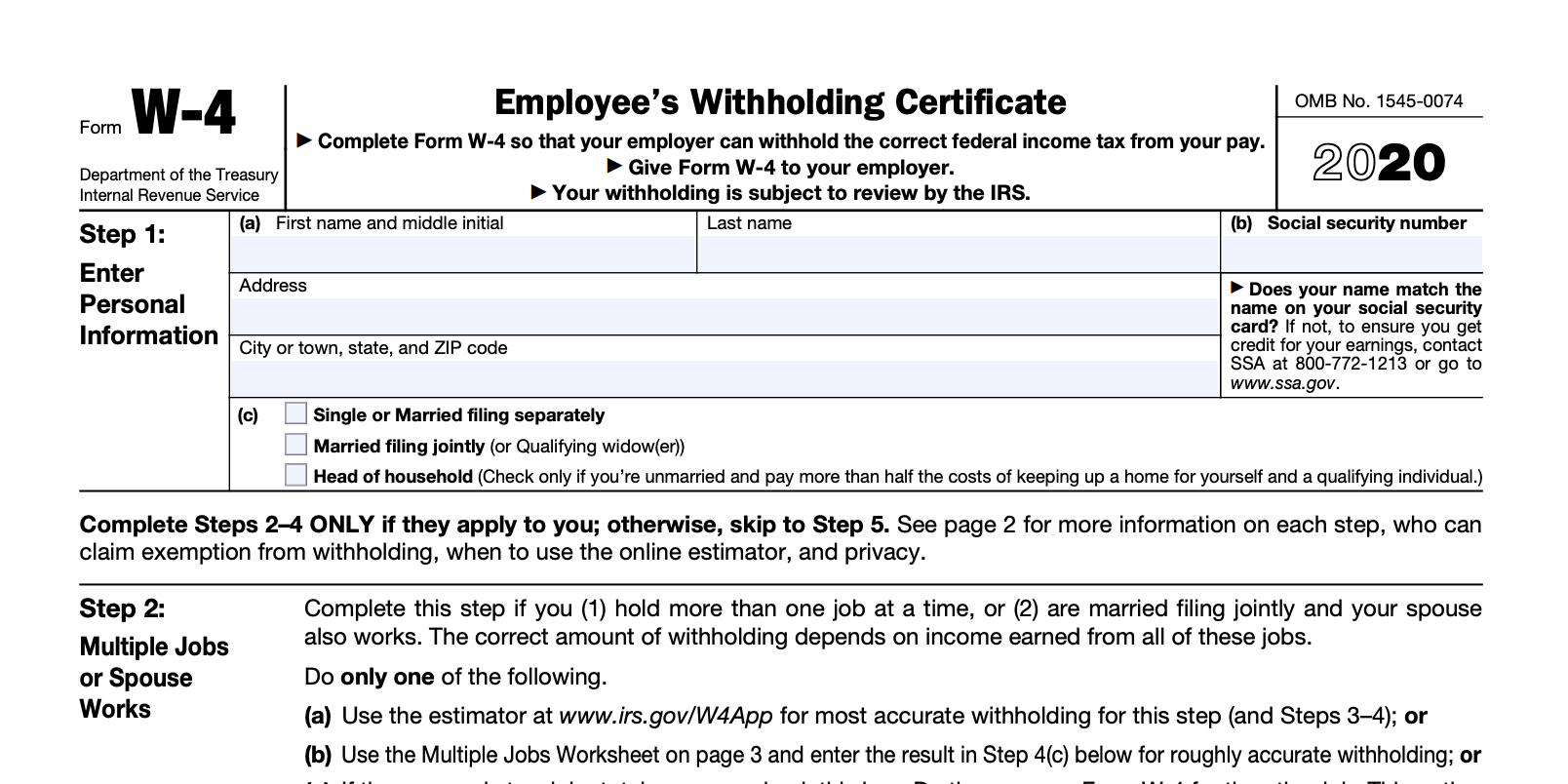

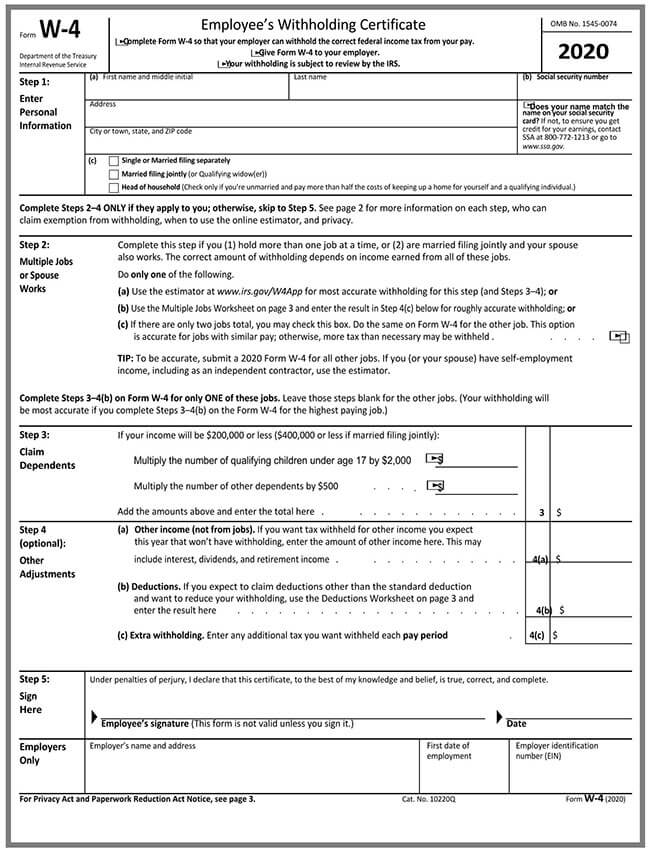

How to Fill a W-4 Form (with Guide)

To provide you with comprehensive guidance on filling out the W-4 form, this resource offers a step-by-step guide. It breaks down each section of the form, explaining how to complete it accurately. By following this guide, you can ensure you meet the necessary requirements and fulfill your obligations.

To provide you with comprehensive guidance on filling out the W-4 form, this resource offers a step-by-step guide. It breaks down each section of the form, explaining how to complete it accurately. By following this guide, you can ensure you meet the necessary requirements and fulfill your obligations.

These resources provide valuable assistance in accessing printable versions of the IRS Form W-4 and offer detailed instructions to help you fill it out correctly. By familiarizing yourself with these options, you can confidently navigate the process and ensure compliance with tax regulations.